certainly a Best practice and earning

Tax free income is even better!

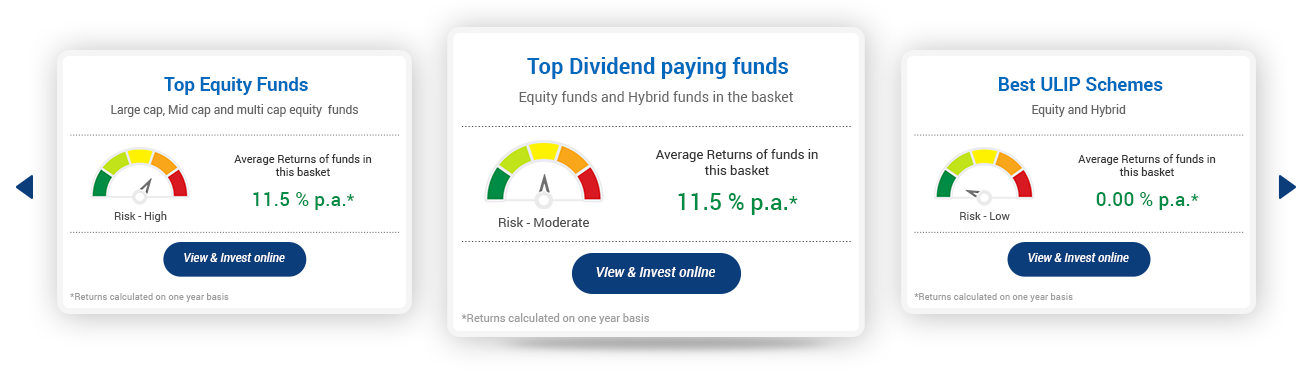

You need to select the best suited option depending upon your age, investment horizon, risk appetite and enjoy the tax free income.

Section 10(34) & (35) with effect from the Assessment Year 2004-05, the dividend income of units of mutual funds received by the assesse is completely exempt from the income tax. Choose the best dividend schemes as per our recommendation or choose on your own to Invest online.

Section 10(38) with effect from FY 2004-05, any income arising to a taxpayer on account of sale of long-term capital asset being securities or equity mutual fund units is completely outside the purview of tax liability especially when the transaction has been subjected to Securities Transaction Tax (STT). So invest in any equity fund now, hold for a period of 1 year and reap tax free gains or start SWP (Systematic withdrawal Plan)

Under Section 10(10D), any sum received under a Life Insurance Policy (LIP), including the sum allocated by way of bonus on such policy, other than u/s 80DDA or under a Keyman Insurance Policy, or under an insurance policy issued on or after 1.4.2003 in respect of which the premium payable for any of the years during the term of the policy exceeds 20 per cent of the actual capital sum assured, is fully exempt from tax.

There are certain types of interest payments which are fully exempt from income tax u/s 10 (15). These are described below:

- Income by way of interest, premium on redemption or other payment on such securities, bonds, annuity certificates, savings certificates, other certificates issued by the Central Government and deposits as the Central Government may, by notification in the Official Gazette, specify in this behalf.

- Stipulated tax free bonds as notified from time to time

10% Slab

20% Slab

30% Slab

Double the returns than Bank FDs at similar risk

Debt Funds are becoming an increasingly widespread rival to the hallowed FD.

Common risk faced by debt funds is interest rate risk with funds losing value in a rising rate scenario and vice versa. Fixed Deposits which have been locked in for long tenures also face this risk in terms of opportunity cost but there is no actual loss of value when the deposit is held to maturity.

As per the current tax rules for debt funds, the minimum tenure for long-term capital gains was extended from one to three years. This means that investors will have to remain invested for at least three years if they want the benefit of lower tax on long-term capital gains. However, there are .5 to 1% exit load if redeemed before 1 year, 2 year and in some cases 3 years. This means debt funds are as liquid as any other open ended investments.

As the returns of debt funds demonstrate, you can beat the bank by investing in debt funds. Debt fund investors assume both credit risk (lending to riskier borrowers) and interest rate risk (the risk of bond prices falling when interest rates rise) and are hence compensated by higher returns. In summary, you can beat the bank by investing in debt funds instead. However you should be cognizant of the risks involved and choose the right fund in order get the best possible deal.

The other big difference is that of taxation. Returns from bank fixed deposits are interest income and as such have to be added to your normal income. Since many investors are in the top (30 per cent) tax bracket, this takes away a large chunk of their returns. Banks also deduct TDS on interest income from fixed deposits. The tax rates are similar for debt funds held for less than 36 months (though TDS will not generally be deducted). However for debt funds held longer than 36 months, returns are classified as long term capital gains and are taxed at 20 per cent with indexation.

investment and tenure

# Last updated on 30th September 2017 | Source www.rbi.org.in

Most experts believe you should have enough money in your emergency fund to cover at least 6 to 8 months' worth of living expenses. What does that look like? Start by estimating your costs for essential expenses, such as: Housing, Food, Health care (including insurance) Utilities, Transportation, Personal expenses, Debt servicing (EMIs). You don't need to include expenses for anything you'd cut from your budget in the event of a job loss or major catastrophe. For example: Entertainment, Dining out, Nonessential shopping, Vacations, Savings for a second home or other expenses. Decide if you need to save more. Putting aside 6 to 8 months' worth of expenses is a good rule of thumb, but sometimes it's not enough. If you're able, you might want to think about expanding your emergency savings.

Here are some scenarios where having more in your savings could benefit you: During a recession (when unemployment rates are higher and the length of unemployment is often longer). If you're in a high-risk industry where layoffs are common. You can build up to it by stashing away smaller amounts on a regular basis, like every week or every pay check.

There are various mutual fund schemes which gives you better than saving account returns with the liquidity of savings account and even can be used to pay to network hospitals or can be used to pay directly to the merchant having the swipe machine.

'Liquid Mutual Fund Scheme' for your emergency requirements

invested for Long term

There are 5 types of equity funds which can be chosen for long term wealth creation. However, one should evaluate the basic risk involved in each of these fund categories.

- ELSS

- Sector Funds

- Equity diversified

- Global Funds

- Hybrid

Equity funds will certainly have volatility component within. However, a smart investor understands that, the Taj Mahal cannot be built in a day, that means for better wealth creation from an equity fund one should keep patience and give enough time to the fund. Generally it is advisable to stay for a minimum of 3 years in any equity fund for better result.

You can also reduce risk in equity by choosing the hybrid route – generally called as balanced funds. These are great funds for investors starting out as they get an automatic allocation to debt and equity by investing in one fund. Or, if an investor already has an equity fund and wants a meagre exposure to debt in his portfolio, he could opt for a balanced fund. The aim of such funds is not to shoot out the lights when the equity market is on a roll, but neither should it crumble like a pack of cards when the market falls.

If the investment period in equity mutual funds scheme is more than one year the capital gain is exempted from tax liabilities. Government of India also provides tax rebate for equity linked saving schemes (ELSS) u/s 80C of Income Tax Act 1961. You can invest into ELSS and deduct upto Rs. 1,50,000/- from your taxable income to effectively reduce your tax liability.